Initially, you will receive by email the Pre-Contract Credit Information.

This important document identifies in plain English the credit amount received by you, the costs of the credit, our commitment to early repayment, and no upfront deductions. The document also states how to proceed with the offer.

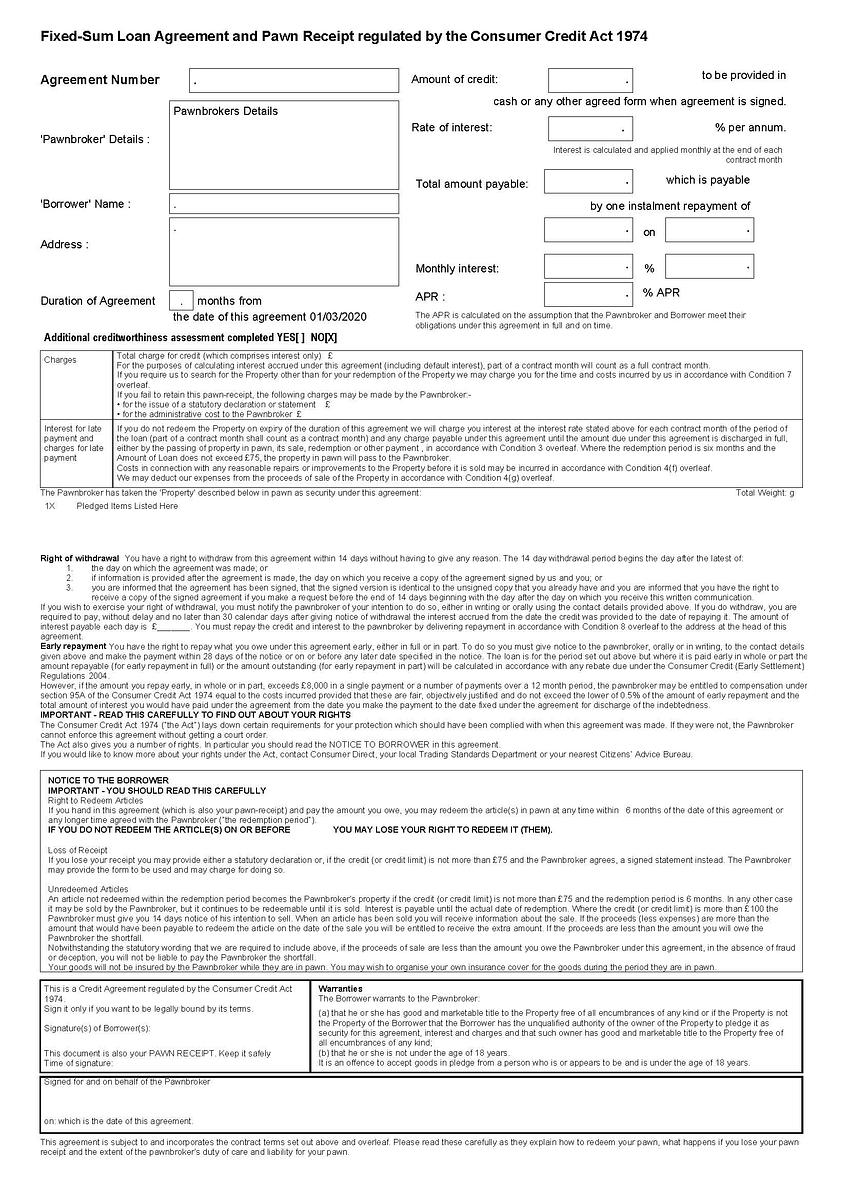

When Bonington has received your assets, the actual valuation of the assets is determined and you receive the loan offer, then once accepted a loan agreement will be sent electronically and an electronic signature is also required.

Do not worry, we have partnered with the leading provider of electronic document signatures. This can be completed on desktop or laptop and mobile phone.

You will be able to download a copy of the agreement and of course always obtain a copy in your Bonington online account.

Registered Address Bonington Loans Limited, 82a James Carter Road, Mildenhall, Suffolk, IP28 7DE

Trading Address Bonington Loans Ltd, 8 Fairways Business Park, Deer Park Avenue, Livingston, EH54 8GA

Telephone number 0131 564 0728

Email address ask@boningtonloans.co.uk

Web addresswww.boningtonloans.co.uk

The type of credit A pawnbroking fixed sum loan agreement

The total amount of credit. This means the amount of credit to be provided under the agreement £5,000.00

How and when credit would be provided The sum of £5,000.00 will be provided upon execution by both parties of the pawn agreement and handing over the item taken in pawn to the pawnbroker.

The duration of the credit agreement 7 months

Repayments One repayment of £7,240.00.

The total amount. This means the amount you have borrowed plus interest and other costs One repayment in accordance with the terms of the agreement you will be required to repay

Security required. This is a description of the security to be provided by you in relation to the credit agreement description of the item you wish to borrow against.

The rates of interest which apply to the credit agreement. Interest rate 3% per annum.

Annual Percentage rate of Charge (APR). This is the total cost expressed as an annual percentage of the total amount of credit. The APR is there to help you compare different offers. 88.7% APR

Related costs.

Costs in the case of late payments. 6.4%

Consequences of missing payments If you do not redeem the article(s) on or before date agreed you may lose your right to redeem it(them). An article(s) not redeemed within the redemption period becomes our property if the credit (or credit limit) is not more than £75 and the redemption period is 6 months. In any other case it may be sold by us, but it continues to be redeemable until it is sold. Interest is payable until the actual date of redemption. Where the credit (or credit limit) is more than £100 we must give you 14 days' notice of our intention to sell. When an article has been sold you will receive information about the sale, if the proceeds (less expenses) are more than the amount that would have been payable to redeem the article on the date of the sale you will be entitled to receive the extra amount. If the proceeds are less than the amount owed, and we have undertaken a separate documented assessment of your creditworthiness prior to entering into the agreement, you will owe us the shortfall. If we have not undertaken such an assessment prior to entering the agreement and your item is sold, if the proceeds of sale are less than the amount owed, we will not pursue you for the shortfall, and we will refund any payments made to date.

Right to Withdrawal You have the right to withdraw from the credit agreement without giving any reason within 14 days. The 14 day withdrawal period begins the day after the latest of: 1. the day on which the agreement was made; or 2. if information is provided after the agreement is made, the day on which you receive a copy of the agreement signed by us and you; or 3. you are informed that the agreement has been signed, that the signed version is identical to the unsigned copy that you already have and you are informed that you have the right to receive a copy of the signed agreement if you make a request before the end of 14 days beginning with the day after the day on which you receive this written communication.

Early repayment. Compensation payable in the case of early repayment. You have the right to repay the credit early at any time in full or partially. If you make a single early repayment exceeding £8,000 the creditor is entitled to claim compensation which will be calculated in accordance with section 95A of the Act.

Consultation with a Credit Reference Agency We will inform you immediately if your application for this product is rejected as a result of the results received from the credit reference agency. We will provide you with contact details and the search results should you wish to contact the credit reference agency.

Registration Number 805272

The regulatory authority Financial Conduct Authority (FCA), 25 The North Colonnade, Canary Wharf, London EH14 5HS www.fca.uk

Concerning the credit agreementThe law taken by the creditor as a basis for the establishment of relations with you before the conclusion of the credit contract English law, unless you reside elsewhere in the United Kingdom, in which case local law will prevail

The law applicable to the credit agreement and/or the competent court This contract will be governed by English law and any dispute may be referred to the Courts of England and Wales unless you reside elsewhere in the United Kingdom in which case local law will prevail.

Language to be used in connection with your agreement The information and contract terms will be supplied in English and we will use English to communicate with you during the duration of the agreement.

Concerning redress Access to out of court complaint and redress mechanism You have the right to complain to the Financial Ombudsman Service, Exchange Tower, London E4 9SR www.financial-ombudsman.org.uk or telephone 0800 023 4567